On April 12, official data showed retail inflation surged to a 17-month high of 6.95 percent in March from 6.07 percent in February driven by high food prices. The Consumer Price Index (CPI) print inflation for March is far above the consensus estimate. In accordance with Reuters polls, economists expect CPI inflation to increase to 6.35 percent.Print the latest inflation confirms the assessment of the monetary policy committee (MPC) which continuously high inflation is a greater concern for future policy makers. MPC has a mandate to maintain inflation in ribbons 2-6 percent and violations of three consecutive quarters will require a panel to explain to parliament why fail to maintain inflation in the band.

How will high inflation affect interest rates ahead?

Most economists expect MPC to change the tariff position to ‘neutral’ in June and follow up with a rate hike at the main policy level (repo) where the central bank lends short-term funds to the bank. The rate increase of 25 basis in the repo combined with changes in the current tariff position looks very possible, barclays said in the note.

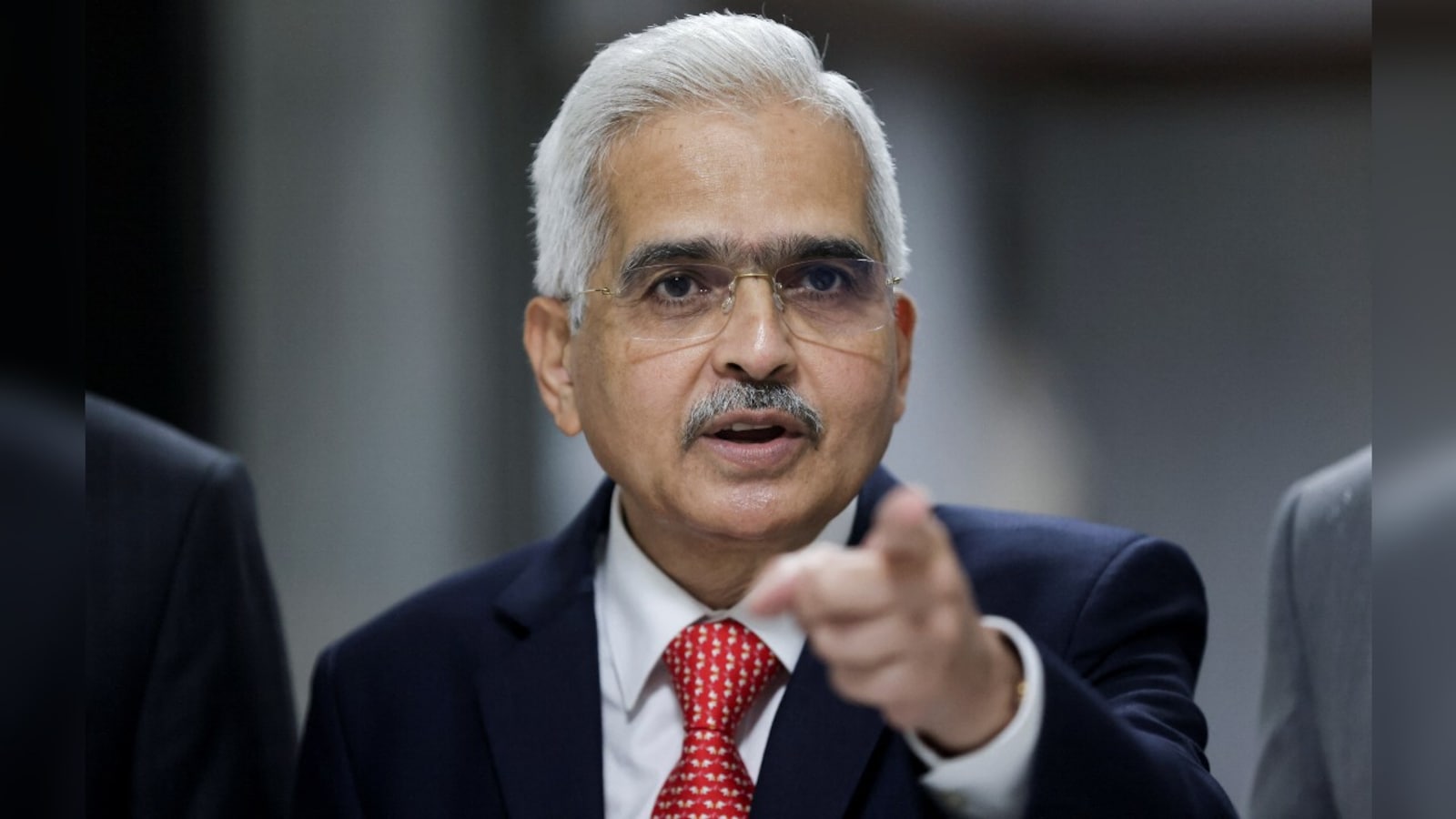

CPI inflation exceeds the target of the RBI range in a material, such as the increase in food, logistics and energy prices added to inflation. We revised our CPI estimate to 5.8% for FY22-23, and now expect four levels of 25bp levels from the RBI in FY22- 23, starting from the MPC June meeting, “Barclays said.In the last policy review, inflation projections were increased to 5.7 percent for FY23 from 4.5 percent, clear recognition that inflation fears could not be ignored by the rate settings panel in growth search.At a press conference that followed the announcement of the policy, the Governor of RBI Shaktikanta Das acknowledged that inflation is now the first priority for MPC now. “We have now been inflation before growth in priority order,” said the watershed.

The inflation trajectory in April-May will be very important. If inflation worries survive and there is no deep shock on growth, interest rates will be carried out later this year. High constant inflation is very worrying about the economy because it is the most painful low-income group.In other words, the increase in inflation grabbed the fruit of economic recovery from the poor. Therefore, policy makers cannot ignore the high prices for a long time. Economists expect April inflation printing to violate a 7 percent sign.

“Accounting for available high frequency prices and today’s data, we are now tracking April CPI around 7.1% Y / Y, which will continue to maintain fears of inflation to remain intact in the mind of the RBI, enter the June policy meeting,” according to Barclays Note.In short, as seen now, the increase in interest rates in June was quite sure which would be the first in a series of interest rates this year.